Capital

OpAMP Capital assists early-stage companies throughout the world in brining their vision to life.

We recognize that virtually every founder wastes an immeasurable amount of time on basic organizational blocking and tackling. We can support them functionally with recruiting, vendor identification, future fundraising, admin, operations, and more. When needed, we become productive members of your team. Founders are under a lot of pressure and, if nothing else, we are always available to lend an ear and help wherever we can.

We like to work with founders who have the technical skills to carry the day, as the root of poor product decision making is lack of knowledge. Steve Jobs, a marketing genius, knew the power of his underlying technology to the point of what was and was not possible. And this technical understanding was an integral part of his ultimate success.

Investing successfully in private companies requires specialized knowledge and know-how; skills that only full-time, highly trained, and educated professionals with dedication and patience have acquired. We established OpAMP Capital to bring forth capabilities that will level the playing field between professional investment funds and private investors by giving private investors what they need to invest successfully.

The OpAMP team typically invests between $250,000 and $500,000 during each financing round. The Fund has provided management assistance to our portfolio companies and helped them with strategic alliances, follow-on financing, mergers and acquisitions, and exit strategy.

Lastly when the time comes, we will help enable your next fundraiser. We can refine your fundraising narrative and facilitate relationships with our downstream partners.

Craig is a proven and accomplished entrepreneurial leader in the high-tech industry.

In his first entrepreneurial experience, Craig was the COO of ProtoStar Ltd., a satellite communications company that provided satellite bandwidth to television broadcasters/operators across Asia. As a co-founder, he was instrumental in raising over $500M in venture/debt and had primary responsibility for the space and ground segment assets for the ProtoStar-1 (Loral) and ProtoStar-2 (Boeing) satellite projects. Craig also served as a board member during a restructuring process that ultimately completed the sale of the satellite and ground systems.

Later, Craig was an executive director for Loral Cyberstar/Skynet. He was responsible for several key telecommunication product lines utilized by key clients. Craig was also on the cutting end of big data architectures as the director of data services for McKesson Corp, and as a sr. technical manager for Computer Sciences Corp.

He holds an MBA from Georgetown Univ. and a BS degree in Electrical Engineering.

Steven has valuable experience advising numerous portfolio companies in the US and abroad. He has developed far-reaching relationships and a firm cultural understanding that is necessary to maximize venture investing success.

Most recently, Steven was the Executive Vice President of Standard Foods, one of the largest food companies in Taiwan. And he also has an abundance of venture experience.

Steven previously served as a managing partner of Renovation Global Fund, a technology-based venture capital fund in San Jose, California. Steven also co-founded Standard Capital (HK) Ltd, an early-stage venture capital fund that focuses on enterprise software and applications.

He holds a Juris Doctorate with a Business Enterprise Concentration from the Northwestern University School of Law and a Bachelor of Arts from the University of California, Berkeley.

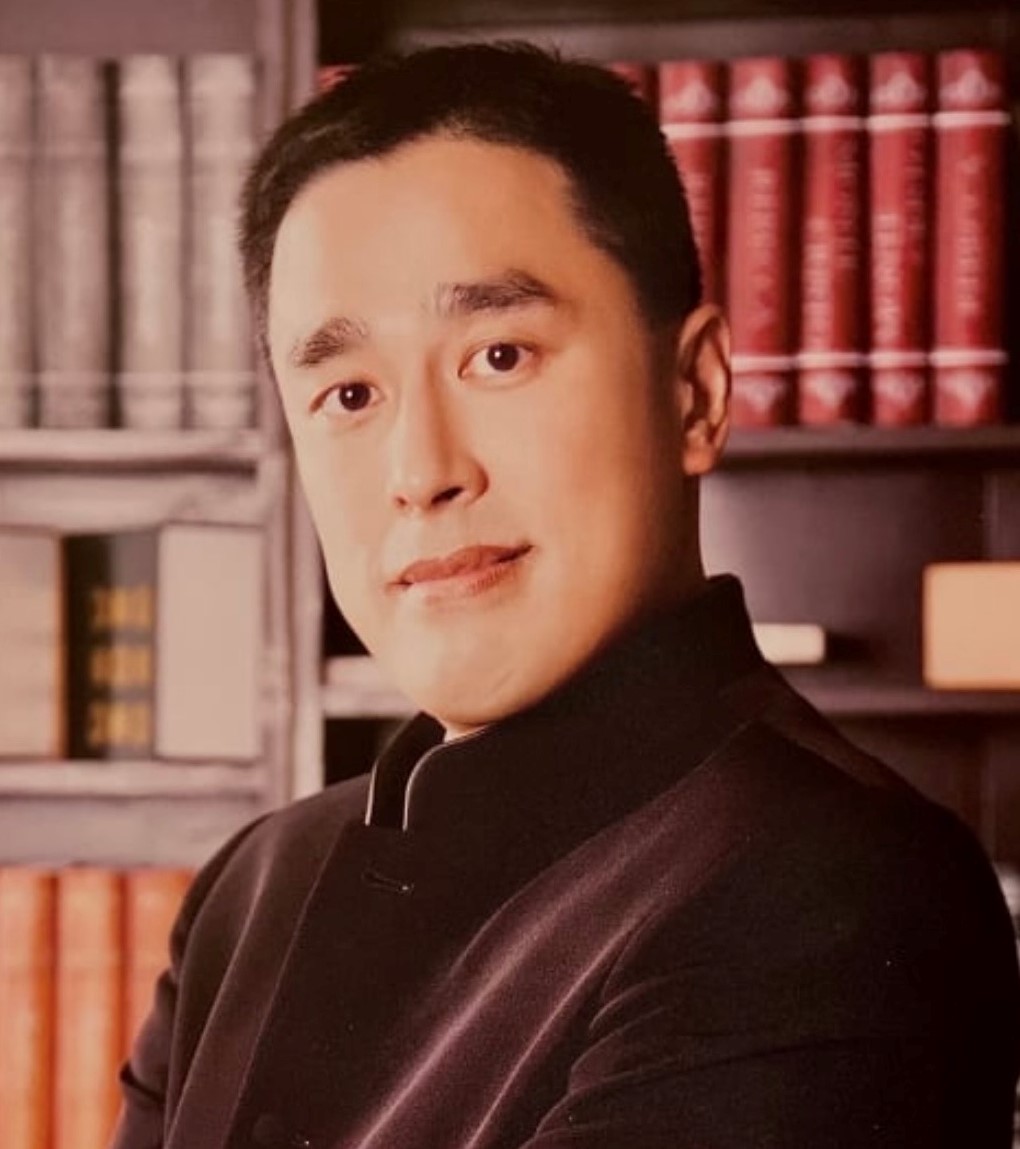

Carson is an active investor in managing enterprises in Taiwan, Singapore, and Hong Kong. He is a prominent member in the business community and political arena. He is a skilled entrepreneur and has cultivated strong connections all over the world.

Early in his career, Carson founded and served as president of American ProImage, Inc., a company in Los Angeles, California that designed and manufactured custom computers systems, rack mounted servers, slim PC, RAID towers, and embedded systems. He was also a co-founder of ViewSonic, a computer Monitor Company with over $1B in annual sales.

Additionally, Carson was previously a managing partner and founder of Renovation Global Fund, a technology-based fund based in San Jose, California. He also served as an advisor and general partner for Seraph Partners, one of the largest Angel Investment Advisory firms in the U.S.

Carson earned bachelor’s degrees in both computer science and history from Virginia Polytechnic Institute and State University.

Josephine is a global venture investor, startup mentor and advisor. She brings extensive international investment experience and aerospace & defense industry expertise. Over the last year, she has co-led and executed 4 early stage investments including an alternative GPS startup, 3 AI space/geospatial data analytics or GEOINT companies spanning maritime domain awareness, and big data integration/fusion to real-time 3D mapping. She is advisor to several Earth Observation, AI geospatial data analytics startups, as well as a member of the Leadership Council @ NSTXL to the Space Force Enterprise Consortium.

Prior to joining OpAMP, Josephine was the Head of Research and Strategic Advisor to Seraphim Capital, one of the most prolific space VCs in the world, leveraging her primary research background in covering stocks/companies deploying emerging technologies that became mission critical to the US government after 9/11. These technologies included commercial spy satellite, drones, robotics, tactical radio, infrared night vision, CBRNE detection, biometric, electronic jammer and Mine Resistant Ambush Protected (MRAP) vehicles.

At Seraphim, she led the first AI geospatial data analytics investment in PlanetWatchers and was involved in deal origination, due diligence, investment committee and strategic partnerships with corporate LPs while supporting portfolio companies with strategy and go to market. Seraphim’s portfolio companies included IceEye, Edgybees, Leo Labs, SatelliteVu, Xona, Hawkeye360 and Pixxel. The Seraphim Space Fund has had four exits through SPAC IPOs (ArQit, Spire Global, D-Orbit, AST SpaceMobile).

Josephine is passionate about tech innovations as they are catalysts for market disruption and transformation. She is excited about the convergence of technologies such as AI, cloud/computing and space tech to solve big problems and create multi-billion-dollar new markets in three key areas: national security, climate and digital transformation.

-

Stage

We prefer to invest in companies at the earliest stages with market validation by way of some revenue. However, we recognize there are situations where a good idea trumps a lack of present sales. You may just need capital to get the wheels rolling! If you have a well-defined growing target market, a distinct and sustainable product, a detailed business model and financial plan, and experienced management, we would love to work with you.

-

Check Size

We are flexible when it comes to investment size, but our preference is to invest $250,000 - $500,000. We can lead your round when appropriate but are also willing to co-invest. When helpful, we can draw on our sizable network of experienced entrepreneurs, founders, and operators to co-invest alongside us to help you complete your round.

-

Interest Areas

While the partnership has core technological competencies from previous experiences, we are also quick learners and are open to opportunities across all sectors. Our mission is to invest in products that have the potential to disrupt existing markets, and our preference is to maintain a balanced portfolio that does not lean too heavily on any one segment of the economy.

However, a common theme for our investments is that the product offering must demonstrate some market disruption. Whether economies of scale, proprietary data, lower cost, superior offering, one of a kind, how is your product going to gain market adoption?

-

Geography

With our experience working across different time zones, geographical location is not a limiting factor for us. OpAmp Capital has partner representation in Los Angeles, Taipei, and the Washington, D.C. area. We are willing and able to work with entrepreneurs coming from any part of the glob

Please submit an inquiry to the right along with your pitch deck. You will hear back from us within 5 business days.